Product–Market Fit Is a Process — Not a Moment

Date February 10, 2026

Author kirsi@gorillacapital.fi

This article is the second part of The Founder Journey, our 12-part series, and the second chapter of Build to Learn.

Build to Learn — Chapter 2

Product–Market Fit Is a Process — Not a Moment

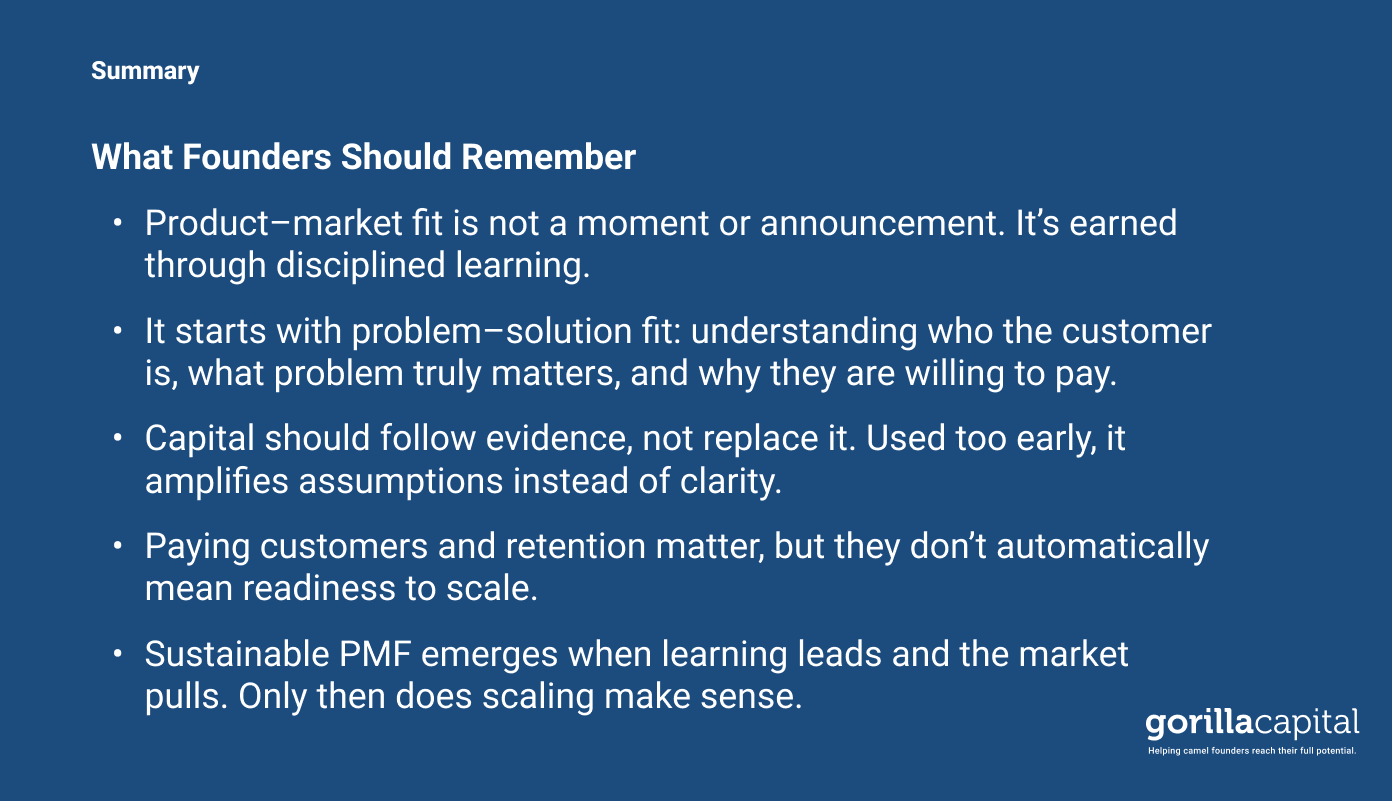

Product–market fit is one of the most talked-about concepts in startups, and one of the most misunderstood. It is often described as a moment, a milestone you reach, announce, and then move past. That framing causes more harm than clarity. In reality, product-market fit is a process.

Founders talk about “finding PMF” as if it’s something you unlock all at once. But what actually happens is slower and more disciplined. PMF is built through a series of learning steps, each one reducing uncertainty and each one earned through evidence. When those steps are skipped, scaling doesn’t create growth. It amplifies what isn’t working.

At Gorilla Capital, we see product–market fit as essential to survival, but not something you jump to. It’s something you work your way into, step by step, starting much earlier than most founders expect.

“Marc Andreessen famously said that the only thing that matters is product–market fit. And he’s right.”

— Sampo Parkkinen, GorillaCast Ep. 2

Problem–Solution Fit Comes First

Before a company can have product–market fit, it needs problem–solution fit.

Problem–solution fit means you’ve shown that a real customer has a real problem, and that solving it creates clear value for them. It’s not about the product itself. It’s about understanding why customers buy, who they are, and what changes for them when the problem is solved. Without that connection between problem and value, there is nothing to build on.

This is the stage where a founder learns whether the problem is worth solving at all.

Does it interrupt behaviour or create a real cost in time, money, or opportunity?

Would the customer pay to have it solved? Or is it simply a nice-to-have they can live without?

There is no growth at this stage. No scale. Often not even a finished product. What matters is learning whether the problem creates enough urgency to act.

Problem–solution fit is the foundation.

Product–market fit is everything built on top of it.

Many founders rush past this step. They lock in pricing, business models, or growth plans before they’ve learned whether the customer truly values the solution. That reverses the order of learning. If the problem is real and the solution genuinely helps, money follows later.

This work doesn’t require large teams or heavy funding. It requires proximity to the customer and a willingness to test assumptions directly.

“I wish it was that easy. Let’s just throw money at the problem. But money has a funny way of making you think you can do a lot of stuff — a lot of irrelevant stuff.”

— Sampo Parkkinen, GorillaCast Ep. 2

At this stage, money rarely accelerates learning. More often, it slows it down by making it easier to avoid the hard questions.

Real learning doesn’t come from positive conversations or polite validation. It comes from observing what actually changes behaviour. When a customer pays, commits time, changes how they work, or comes back on their own, something real has been learned. When they don’t, that is learning too.

This is why problem–solution fit must be earned before anything else. Without evidence that customers are willing to act, not just agree, there is nothing meaningful to scale.

Product–Market Fit Is Earned, Not Declared

Product–market fit doesn’t arrive with a press release. It shows up in behaviour when customers pull the product forward without persuasion.

That pull is visible in small, concrete ways. Customers come back without being pushed. They use the product because it solves something real. They’re willing to pay. They’re disappointed if it disappears. These signals emerge gradually, not all at once, as founders tighten the loop between problem, solution, and evidence.

Seeing these signals requires restraint. If too much money is poured in at this stage, founders start compensating instead of learning. Buying traffic, incentives, pilots, or attention to create momentum. Activity increases, but clarity decreases. It becomes difficult to tell whether the market truly wants the product, or whether demand is being manufactured through spend. PMF can’t be bought. If it’s forced with money, it won’t hold once the pressure is removed.

This is where capital efficiency becomes critical. When resources are limited, founders are forced to focus on what actually moves learning forward. When resources are abundant, it becomes easier to do things that look right, but are wrong for the company’s current stage.

This is the core lesson of the startup J-curve. Early on, companies are still in the learning dip: validating the problem, testing value, and earning the right to grow. Money doesn’t change where you are on that curve. It only increases the risk of acting as if you’re further along. Scaling before understanding, spending before validation, and building infrastructure before demand doesn’t accelerate progress. It deepens the dip and makes recovery harder.

The problem isn’t money itself. It’s using it to jump ahead on the curve instead of moving through it step by step.

What PMF Is Not

Product–market fit is not defined by headcount, burn rate, or funding rounds. It is not a roadmap filled with features or early traction driven by incentives and pressure.

Those things can create activity, but not clarity. Without PMF, they show that something is happening, not that the company is moving toward a sustainable outcome. Teams get busy, metrics move, and effort increases, but it’s unclear whether the business is actually getting closer to something customers truly want.

We often see founders pushed to “show progress” before the fundamentals are in place. The result is premature scaling: hiring, spending, and expanding before the company understands what truly works. Once that happens, the business becomes harder to correct. Decisions get locked in, expectations rise faster than understanding, and learning slows down when it should be accelerating.

Let Capital Follow Evidence

In Gorilla’s model, capital is tied to milestones. Not stories.

Money exists to reduce uncertainty, not to replace learning. Its role is to help founders test assumptions, validate what works, and earn the right to the next step. It is not meant to shortcut understanding, perform progress, or push the company into a stage it hasn’t earned yet.

This matters directly for product–market fit. Capital should support the work required to reach PMF, not replace it. When customer-driven learning alone is no longer sufficient, capital can accelerate what has already been validated, not jump ahead of it.

The healthiest path is sequential and customer-led. It starts with problem–solution fit, then moves quickly toward paying customers. Early revenue is not optional. It is the strongest signal that the problem is real and the solution creates value. Ideally, the company begins funding itself through customer cash flow as early as possible, using external capital only to accelerate what customers have already validated.

Even paying customers and retention don’t automatically mean a company is ready to scale. Before adding fuel, the fundamentals must hold. A clear and narrow ICP, a repeatable way to acquire customers, and a sales motion that works beyond the founder. If these aren’t in place, adding spend often increases CAC, hides weaknesses, or creates growth that collapses under pressure.

Capital works best when it follows the evidence. Each stage earns the next. When money comes too early, it doesn’t speed things up. It amplifies what isn’t ready yet.

Learning Is the Real Early-Stage Advantage

At the early stage, the speed of learning matters more than the speed of execution.

Founders who reach product–market fit are rarely the ones who build the most or move the fastest. They are the ones who learn quickly because they stay close to the problem, resist premature scale, and let evidence guide decisions.

This is why Gorilla’s approach to PMF is deliberately disciplined. Company building is a learning process, and skipping steps doesn’t save time. It compounds risk.

Final Reflection

Product–market fit isn’t a moment you arrive at or announce. It’s something you earn by turning uncertainty into evidence, one step at a time.

Howard Love’s Startup J-Curve captures this well: before growth, startups move through distinct learning phases. Each phase has a job to do, and PMF only appears when those jobs are done in the right order.

Early work is about framing the problem and putting something imperfect in front of customers. Not to scale, but to learn. Assumptions meet reality, and feedback replaces belief.

The hardest work comes in the middle, where problem–solution fit is tested and refined. Customers sharpen the problem. The solution evolves. Progress can feel slow or messy, but this is where foundations are built.

Only after that does product–market fit begin to show itself, quietly, through repeat behavior, retention, and willingness to pay. Scaling belongs after that, not before.

Start with the problem.

Prove the value.

Let customers pull you forward.

When learning comes first, growth follows naturally, and product–market fit stops being something you chase, and becomes something you’ve earned.

Next in The Founder Journey:

Milestone-Based Funding