Capital Efficiency Is Not Optional — It’s a Competitive Advantage

Date November 11, 2025

Author kirsi@gorillacapital.fi

This article is the first part of The Founder Journey, our 12-part series — and the opening chapter of Build to Learn.

Build to Learn — Chapter 1

Capital Efficiency Is Not Optional — It’s a Competitive Advantage

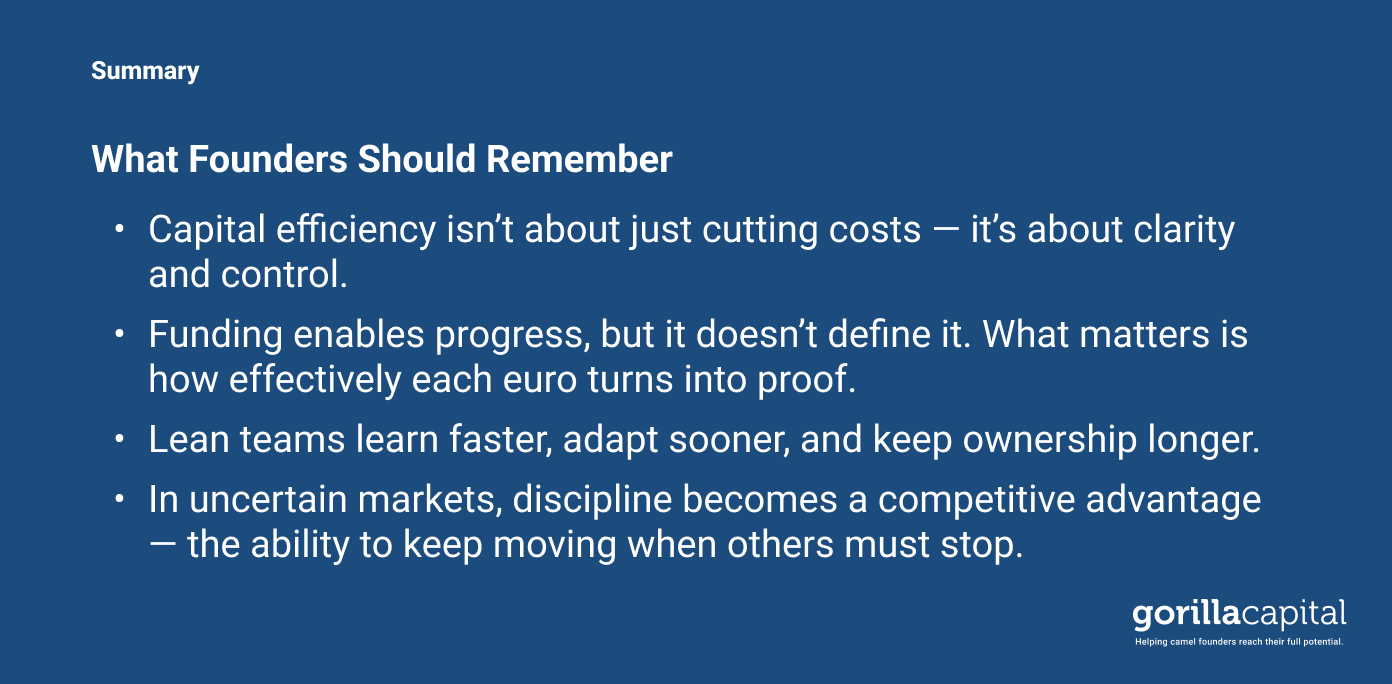

After years of cheap capital and “growth at all costs,” the market has changed. With funding becoming harder to secure, every startup journey is a balance between ambition and resources. Funding enables progress, but it doesn’t define it — and at times, it can even be counterproductive. What truly matters is how well each euro turns into proof that the problem is real, the solution works, and the business can stand on its own feet.

Founders today need a new mindset: one built on proof, discipline, and long-term leverage. That’s where capital efficiency comes in.

At Gorilla Capital, we believe how you use money matters more than how much you raise. Capital efficiency isn’t a constraint. It’s a strategy — the foundation for lasting success.

The Myth of “More Is Better”

There’s a common narrative in startup culture: raising a big round is a signal of success: the victory post, the headline, the validation. But that story hides an uncomfortable truth: most big rounds don’t lead to big outcomes. In reality, startups that get to real traction with modest capital outperform in the long run.

Why? Because they’re focused, adaptable, and resilient — and because they understand one key reality: most exits aren’t unicorns. In the Nordics, many tech exits land below €20M, yet startups often raise and plan as if they’re headed for €200M outcomes. We’re not in Silicon Valley. A €10–20M exit is a strong result, and designing the company around what’s most likely doesn’t limit ambition — it makes success repeatable.

Why Capital Efficiency Matters More Than Ever

It maximizes founder ownership.

The less you raise early, the more equity you retain when your startup begins to scale.

It keeps the business focused.

Scarcity forces clarity. Teams that operate lean execute faster and waste less time on distractions.

It reduces existential risk.

Raising too much too early can backfire — with inflated burn rates and expectations that can’t be justified later.

“The more money you raise, the more likely you are to fail.”

— Risto Rautakorpi, GorillaCast Ep. 1

Scarcity Drives Clarity

In Gorilla’s portfolio, the healthiest growth stories are often the leanest. Efficiency doesn’t slow them down — it compounds progress. We believe that when capital is a constraint, creativity thrives. And the data backs us up: lean startups are often the ones that endure the rollercoaster of early-stage growth, because they’ve learned discipline from day one. It becomes part of the culture.

Too much money doesn’t fix problems — it hides them. When capital is abundant, inefficiencies stay buried under growth metrics and headcount. Scarcity, on the other hand, exposes what truly works. It forces founders to solve real issues early — when fixing them is still cheap.

A healthy early-stage raise isn’t meant to last forever. It’s meant to take you to the next milestone, one backed by real proof. That proof could be problem–solution fit, your first paying customers, or early revenue scale. Reaching that milestone unlocks the next phase, with stronger terms, better leverage, and a clearer story to build on.

“I wish it was that easy — just throw money at the problem. But money has a funny way of making you think you can do a lot of things, often irrelevant ones. You don’t need money to learn. In fact, it can get in the way.”

— Sampo Parkkinen, GorillaCast Ep. 2

The Gorilla Way

At Gorilla Capital, efficiency isn’t just advice — it’s built into how we invest.

Our model is designed for founders who raise to learn, not to perform. We invest milestone by milestone, linking capital directly to proof points like problem–solution fit, paying customers, and early repeatability. When learning compounds, value follows naturally.

Capital efficiency isn’t about just cutting costs; it’s about control. Founders who stay disciplined early keep ownership, flexibility, and the freedom to make the right decisions later.

Signs You’re Running Efficiently

- You can explain your next milestone in one sentence.

- Every euro you spend supports learning or revenue.

- You measure progress by proof, not by runway.

- You know what “enough” looks like for this stage.

When founders spend efficiently, they generate proof — not pressure. That proof becomes leverage: it leads to better terms, clearer stories, and real control when it’s time to raise.

And when it’s time to raise, our message is simple: don’t raise what you can — raise what you should. Start with what’s most likely, not what’s most aspirational. Build for the €10–20M outcome and design the company so that this kind of exit makes everyone a winner. From there, the upside is optional, but sustainability is essential.

We’re not chasing hype or huge raises. We’re backing builders who operate lean and build for the long run. Camels are built for endurance, not speed — and so are the companies we fund.

Final Reflection

This is where every great founder story begins. With discipline, not funding. Because the companies that last don’t chase money; they master how to use it.

Next in The Founder Journey:

Finding Product–Market Fit — The Proof That Changes Everything.