Gorilla is a different kind of VC firm

Here is a article one of our portfolio founders, Jacob from Vinter.co wrote. Definitely worth to read

https://medium.com/@jacob_lindberg/gorilla-is-a-different-kind-of-vc-firm-71a8568c1143

Here is a article one of our portfolio founders, Jacob from Vinter.co wrote. Definitely worth to read

https://medium.com/@jacob_lindberg/gorilla-is-a-different-kind-of-vc-firm-71a8568c1143

“You can never fully convince someone he is wrong, only reality can” - Nassim Nicholas Taleb

The iconoclast authors words ring eerily true for most of us, who never seem to realise our own mortality in the face of an ever increasing amount of stress and workload.

Despite light warnings and hints from (some) of my own investors regarding my pace and lack of recovery, I simply frowned and replied that I could take the heat. In my mind, only losers burnt out.

I kept flying towards the sun with the confidence of Icarus, fully convinced of my own invincibility. Until I was not.

Hemingway’s quote of how to end up in bankruptcy rang familiar. My personal demise had occurred “gradually, then suddenly.”

When burnout strikes, the warning signs can be subtle. For my part it was higher blood pressure and sleeping problems. The day it finally hit me, changed my life forever.

Since that fateful day in May 2017 when I experienced severe pain in my lower abdomen and back combined with a crippling anxiety I have left my company and spent almost 1,5 years in recovery. The total time in pain and anxiety has been around 2,5 years.

Is it possible to take pre-emptive measures?

As stated quite bleakly in the beginning of this article it is difficult, mostly because of many founders’ strong belief in their own invincibility. For most, reality will wake them up.

However, I strongly believe that it is not necessary to repress feelings of passion and drive in order to stay away from burnout, but rather build “cushioning” around everyday life. Even small things will aggregate to great benefits over time.

So what are the things one can do to build a robust defence to stress and passionate drive?

1. Meditation - a practice of meditation has so many benefits it is almost incredible this is not recommended to all founders. It is one of the most powerful stress reducers while at the same time bringing much clarity to thinking. Stay in bed every morning for a 5-20 min meditation before doing anything else. Give your body a pleasant wake up.

2. Do not bring your mobile to your bedroom - the mobile phone is one of the worst things that has entered our lives in terms of sleep, if not the worst. The stress of notifications, mail and blue light is a great destroyer of restorative sleep. Leave your mobile outside and never let it in. If you are concerned with waking up, buy a regular alarm clock.

3. Focus on good sleep. According to Matthew Walker (author of the brilliant book Why we sleep, get it now) sleep is so powerful it is actually remarkable how living organisms ever woke up. It is the greatest superpower we humans can have. It’s effects on health are just ridiculous.

So, if you want to head straight to a burnout, please avoid the tips above, otherwise, take care of yourself. This will leave your investors, clients, wife, girlfriend, dog, cat and above all yourself, much much much happier.

Tomi Kaukinen - Keynote speaker, serial entrepreneur, burnout survivor - Licence to Fail (www.licenceto.fail)

After working with hundreds of different kind of startups in different industries, I must say that startups tend to do common mistakes.

The most common mistakes in my “list” are:

Here is also a good video from Y Combinator partner about the biggest mistakes First-Time Founders make ( https://blog.ycombinator.com/the-biggest-mistakes-first-time-founders-make/ )

Money is always a consequence, not the root cause. You work – you get paid. You sell – customer pays. You roll the dice and get lucky – you get rich. You have a business (plan) that works – you get funding.

But getting funding is not the end goal, not even for a startup. The end goal is to be able to pay all that funding back, and some more. To reach that you need to have a business that works. For getting there, you need the right strategy. The strategy should be all about your business: who is your customer, what is your offering, how you plan to win etc.

The journey from where you are today to where you need to be one day is typically so long that you may need to top up some fuel on the way. Funding is your fuel, helping you to get where you need to go. But it’s just a means to an end, not the reason your startup exists and definitely not your Northern Star. It should not be the driver for your thinking and activities, do not let “what do I need to do to get funded” to mislead you.

Corporate way of thinking: We carefully prepare a plan. Then we implement it precisely. The results will be as stated in the plan. Failure is due to bad execution.

Startup way of thinking: My plan is not really a plan, it’s just a sum of my hypothesis. For sure it will be wrong but I don’t know where and how. I need to run lots of structured experiments to test my hypothesis. When I have validated my assumptions, I may have a plan that is worth something. Failure is due to not running enough different “tests” with customers.

Many startups behave like corporates in this regard, assuming their plan will work – just throw in money and people and voila. No. Be very aware that until you have validated your assumptions you do not have a plan. Then you can not be implementing a plan (read: scaling), all you can do is run experiments.

The result of an experiment is to increase your knowledge – does this work, Yes/No. The job of a startup is to run experiments. A good startup learns a lot while spending very little effort and money. A bad startup spends a lot and doesn’t learn much. Cost efficiency of your learning should be a key objective while in the experimental phase (=all phases before scaling, by which time you should have a validated plan you can just implement). Cost efficiency of running your operation should be your key objective once at the scaling phase.

Most modern literature refers to just OKRs (https://www.perdoo.com/the-ultimate-okr-guide/) but I prefer adding Goals to it as well – as Microsoft did back in the 90´s. You need to have defined a clear Goal first before Objectives makes sense. Anyway, the operational stuff is captured in the OKRs (without the G) so no need to split hair on semantics, both work.

The power of the OKR driven operation is explained well in (https://www.amazon.com/Measure-What-Matters-Google-Foundation/dp/0525536221). If you google “measure what matters” you find a lot of material, Youtube videos etc to give you a crash course. Though the examples in the book are very big companies, the method works well for startups as well. Actually they may be even more critical for a startup, as “what matters” is dependant on the stage of the J Curve you are at. As you make progress, “what matters” should change. The thing to drive your everyday activity is the Key Result. The name is a bit misleading, it should rather be “Key Activity”, but this is the standard term so we stick with it.

There are no strict rules for that as the whole PMF concept is somewhat abstract and vague. But there are (semi)objective ways to assess it. What exactly works is depending on the context so you need to identify the relevant criteria for your case. However at the end it boils down to this (by Eric Ries)

“If you have to ask if you have found it, you haven’t.”

Some things to monitor/measure that are indicators of PMF (more precisely, the “customer love” or “market pull” part of PMF):

Our own formulation of a litmus test to determine whether there might be PMF:

Provide evidence of 3 separate measured tests of your customer behaviour that demonstrate your product/service is significantly (=order of magnitude) better than the existing solution.

“Product Market Fit is when customers sell for you”.

“Glimmers of false hope is not the same as customers wanting to rip it out of your hands. Product Market fit feels like a landmine going off.” Peter Reinhardt

“The number one problem I’ve seen for startups, is they don’t actually have product/market fit when they think they do.”Alex Schultz

“80% of SaaS companies never make product market fit.” Peter Reinhardt

“Startups need 2–3 times longer to validate their market than most founders expect. This underestimation creates the pressure to scale prematurely.” (Startup Genome Study)

“You are able to articulate your different problem/solution fit(s) in detail”.

Before you can achieve product/market fit, you need to understand and be able to articulate your problem/solution fit(s) in detail - not in “generic” level or in generic terms (https://gorillacapital.fi/problem-solution-fit/).

Problem/solution fit needs to indentified & verified prior you can start looking for product/market fit or scaling. Here is a presentation that can help you on identifing the problem/solution fit.

Typically entrepreneurs feel pressure - both “internal” and external - to rush to scale. Many time even without understanding their problem/solution fit and how it differs between segments.

This results in not finding product/market fit or in inefficient and pre-mature scaling (read waste of money).

The aim of problem/solution fit process is to be able to identify the best opportunity to pursue further.

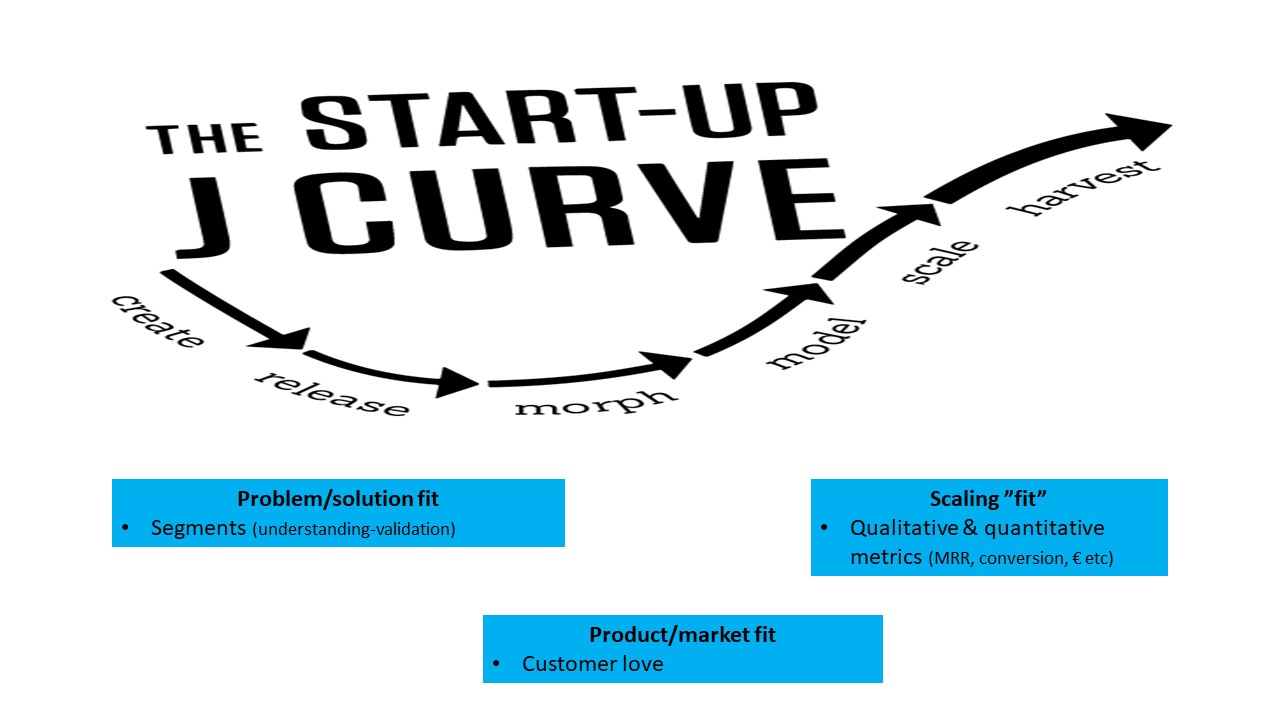

Startups have different stages. Howard Love has well articulated the different stages and we have included the problem/solution fit, product/market fit and scaling “fit” for you to understand how these stages overlap each other.

Where is your startup ? What are the KPI’s relevant for the stage you are in ? Have you “overleaped” one of the stages ? What kind of verification and facts do you have ?

Absolutely we want everyone to reach as high as their abilities allow them to! A unicorn would be fantastic! A lot of what we say should be preceded with “until proven otherwise”. As we believe in data and statistics, we assume the median type outcome as the placeholder – UNTIL PROVEN OTHERWISE. I.e. once you have evidence that you can do better and reach higher than the typical/median case, then raise the bar! But you need to prove you can walk until you try to run. And until you have proven your ability to run, you should stay on a route where running is not mandatory.

One reason is our personality – we are all “glass is half empty” people, so we look at everything from that angle. But we don’t intend to be negative or judgemental, we are simply analytical and fact driven and we believe in statistical math, not fairy tales. We are ultra-curious and we always want to understand. When we ask questions people have no good answers for, some people take it as a negative. Sorry, then we clearly do not have an alignment in the basic philosophies and we are not meant for each other.

The overarching higher cause for us is about making the whole startup community aware of an alternative to the stereotypical “how to raise as much money as possible” thinking (which results in having to tell a really bold story to pump valuations up, and everything that forces you to do). We want to help build more successful startups, which reward the founders and investors for the risk-taking. One cornerstone of that is the acceptance of basic facts such as statistical probabilities of success in different scenarios. Hence we favour a rational approach to risk and funding, as on average the survival rates are much better when your plan does not depend on winning-the-lottery type odds.

(People who have already done several exits at tens of millions – you can skip this part)

If you want to make an informed decision you should understand the odds – some basic statistical math. What matters are not paper valuations on which money has been raised, but realised exits where founders and investors received money back. So lets look at some exit facts:

Trade sale = someone bigger than you buys your company outright. For the buyer, your company/it’s business are a nice complementary add-on to what they already have (they have a brand, customers, channels, salespeople etc – but they have a critical hole your company could fill)

Early Stage = this refers to the stage your business is at, not to the calendar age of the company. The sweet spot is that you have found (at least v1.0) of your product/market fit and demonstrated sufficient proof of it working in real life, but you have not yet built “real” business of it.

In essence, in an early stage trade sale the seller sells a recipe for growth for a buyer who believes they can do the baking of that growth based on that recipe.

We have been there ourselves.

Gorilla partners have founded companies, scaled them (up to 100m€+ turnover) and exited them. We have worked hands-on with startups for 10+ years, of our 2 funds we have to date invested in 50+ startups (+ our own personal angel investments). We have screened thousands of startups, analysed closely hundreds and worked hands-on with 100+. We have an analytical mind so we have seen what works and what doesn’t. Everything we believe in is based on either our own first hand experience, or objective data available to anyone.